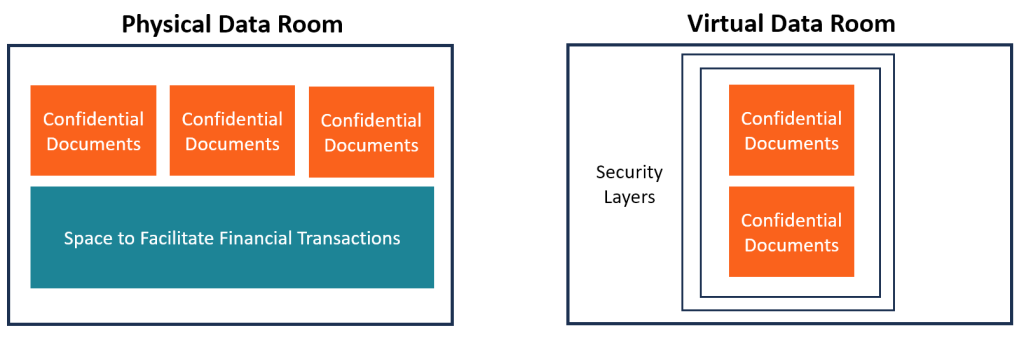

A data room is a digital repository that stores sensitive documents in a safe manner. It is used for variety of business transactions like M&As and fundraising as well as legal processes. It is also helpful in managing intellectual property and in collaborating with customers and partners. It allows all stakeholders, which includes partners and customers, to access documents and make comments on them in a central location while maintaining an extremely high level of security.

The most frequent use coding of a virtual data room is in the event of a merger or acquisition. The seller will set up a VDR, and invite bidders to the data room to review the details. The seller can monitor who is viewing the documents and allow users to ask for clarifications from within the platform.

Another important aspect to be aware of is that a data room should only contain information that is relevant to the specific transaction. This is crucial, since it will prevent investors from being distracted by irrelevant information and thereby slowing the due diligence process. It is also recommended that separate rooms for investor data be set up for each stage of an investment process. This will make it easier to organize information and make sure that potential investors only have access to information that is relevant to them.

Some founders are worried that a dataroom will slow down the process of a deal since investors might find it overwhelming to review all the information all at once. This is a legitimate concern however, it’s important to keep in mind that the aim is to provide data that can help you close the deal.

More Stories

Εισαγωγή στο Regency Casino και τις υπηρεσίες λεωφορείου

Εισαγωγή στο Malina Casino 6

Πλάνο Άρθρου: Crown Casino Online