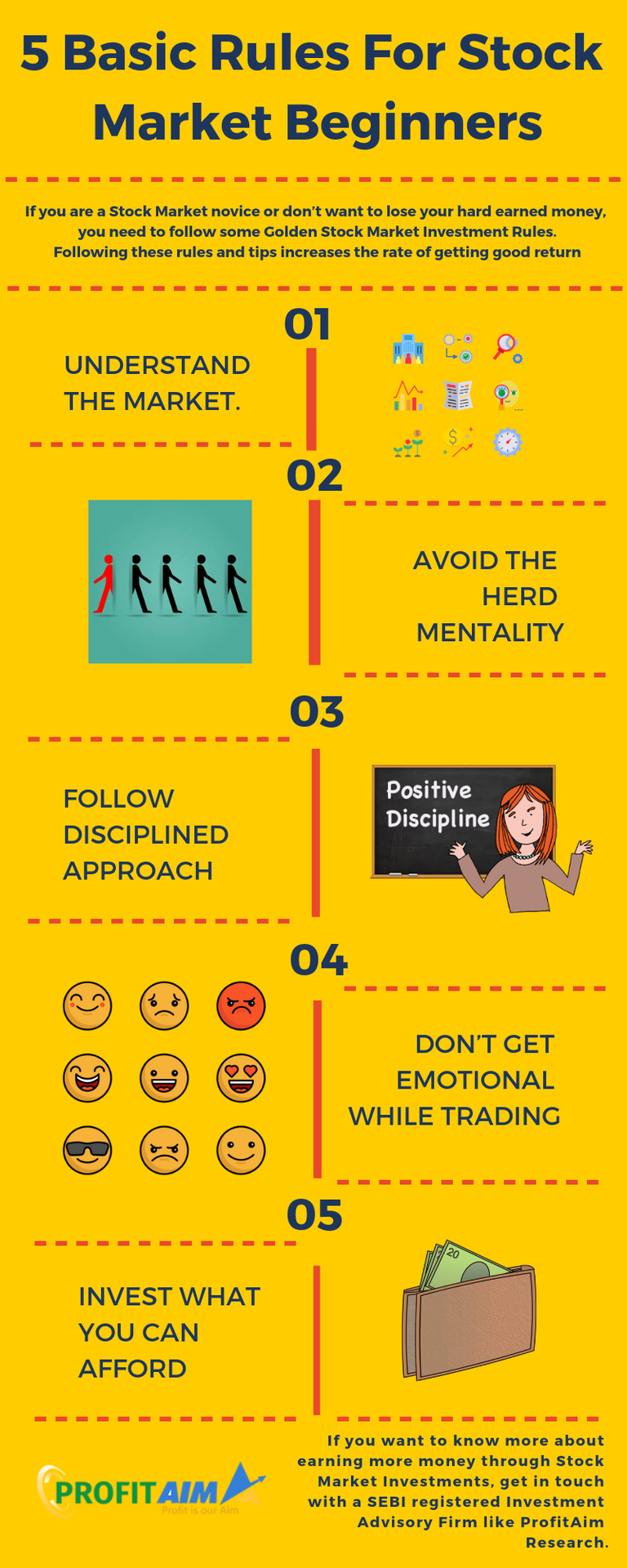

The idea of investing your savings is among the best ways to increase your wealth, especially if you do it wisely. However, the process of starting can be overwhelming and novices often make costly mistakes. Here are some guidelines to avoid making costly mistakes in the market.

1. Learn the fundamentals of investing.

The stock market is where securities are traded, including stocks, corporate or government bonds and exchange-traded funds. Essentially, it’s an auction where a publicly traded company sells shares to investors in exchange for capital. Investors buy and sell these shares when they think the company’s value will increase or decrease. The value of a stock is affected by many aspects, such as the state of the economy, environmental disasters and war.

2. Be sure to keep your investment goals in the long run.

Most financial experts recommend staying invested in the stock markets for a long period of time – at least 5 years. This allows you to build up your portfolio, and to weather the inevitable losses of volatile markets. Many new investors are enticed either by the quick-term gains or lose their patience when markets fall and sell their stocks too early.

3. Diversify your portfolio.

Diversifying your portfolio reduces its risk. Diversifying your portfolio into different industries, asset classes, and geographical region is important. Avoid investing too much in a single company. This is known as “concentration risk” and can be fatal if the company is facing issues such as regulatory issues or public relations crisis.

More Stories

Εισαγωγή στο Regency Casino και τις υπηρεσίες λεωφορείου

Εισαγωγή στο Malina Casino 6

Πλάνο Άρθρου: Crown Casino Online