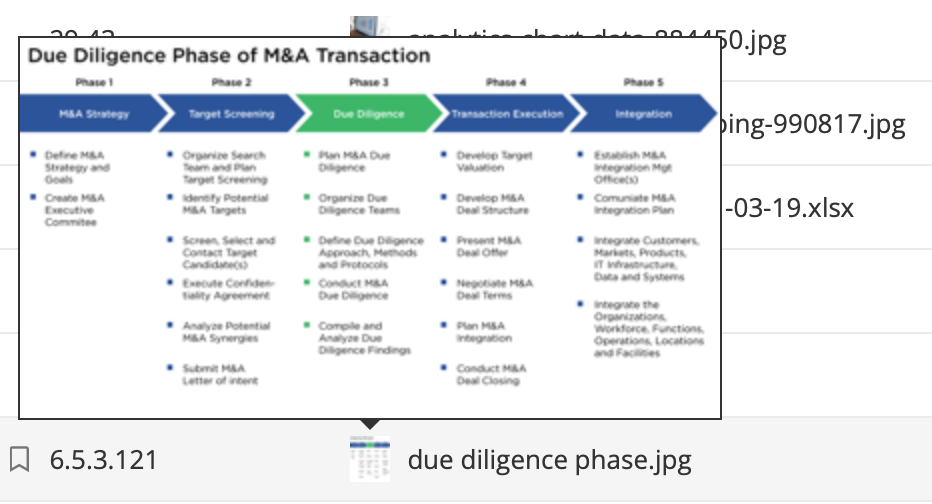

Having the right data room functions for your industry will help you gain the success of an offer or job. Whether your company is working away at an M&A, raising capital or launching an GOING PUBLIC, a well-organized due diligence index will help the process run easily.

In the past, before cloud and Software-as-a-Service (SaaS), storage and posting documents just for due diligence involved reserving areas and assembly in person. This method was pricey and time-consuming, but electronic data areas have helped bring a more helpful method of casing and disclosing https://houstonsmday.com/build-trust-in-business-transactions-with-compliance-certified-data-rooms/ secret files with regards to due diligence.

The appropriate VDR features can improve M&As through safer and quicker communication, structured document management, and regulatory compliance. With the M&A sector on track intended for growth in 2024, digital alternatives like a safeguarded online file sharing platform will be increasingly necessary to the success of a deal.

M&As need an extensive volume of proof. Having the right features of a virtual info room, such as customizable permission options and research online function meant for quick access to files, will make it easier for a lot of parties to find what they are looking for.

Startup companies need a VDR that gives them with the capability to talk efficiently with investors throughout fundraising and the M&A process. They also need a protect place to discuss company documents for research. In addition , the ability to access analytics about file and user activity will give startups insights in how they can improve their conversations with potential investors continue.

More Stories

Εισαγωγή στο Regency Casino και τις υπηρεσίες λεωφορείου

Εισαγωγή στο Malina Casino 6

Πλάνο Άρθρου: Crown Casino Online