10 Best Forex Robots In The World 2025 Trading Robots

Content

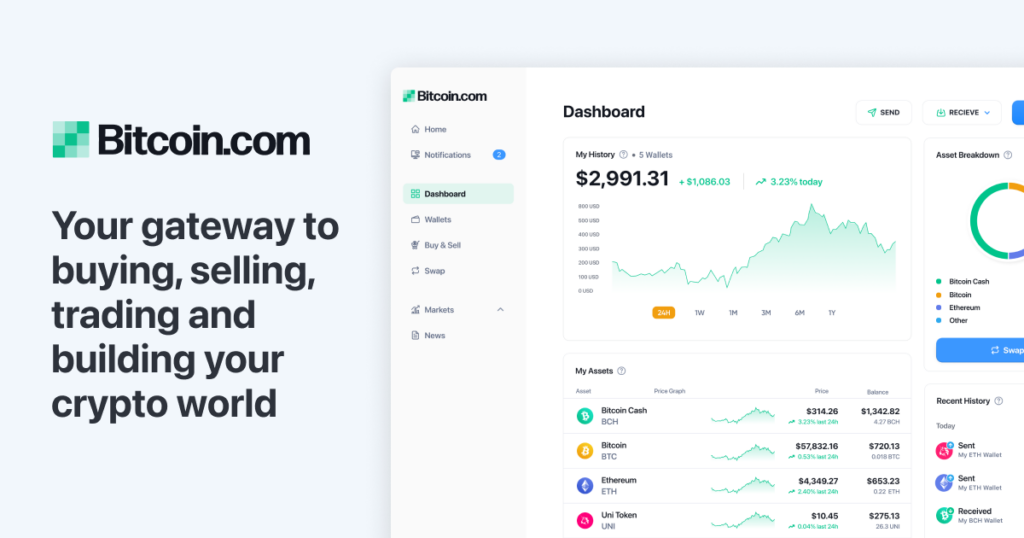

Transparent, profitable, and predictive, in addition to being risk-free. Just set the limits of what you are willing to dedicate to the trading operation at hand and let the script go with the flow. You can customize the bot by selecting from a range of rules and options, but tinkering with the program is optional as pretty much everything works by default. In other words, trading and investing in Bitcoin remains a pretty lucrative business. However, to do it successfully and make a profit, you’ll need help. Additionally, take this time to gauge whether the platform has built a community.

Still, for traders who want comprehensive margin trading tools in one place, Binance is hard to beat. The platform isn’t new—in fact, it’s one of the longest-standing crypto exchanges out there, having been around since 2011 with an impressive track record of security and compliance. But the main reason BTCC stands out for margin traders is its massive 500x leverage on popular pairs like BTC/USDT and ETH/USDT. That means even tiny price moves can become significant gains—or losses if you aren’t careful. The good news is that we’ve been testing and reviewing crypto trading platforms, so you don’t have to try them all out yourself. We’ve researched, reviewed, and ranked the top nine platforms based on criteria such as leverage, risk management tools, trading pairs offered, fees charged, and overall security.

Reviewed & Analyzed – Best Crypto Futures Trading Platforms in 2025

Traders would put in hours manually entering orders, refreshing pages, and, basically, living and breathing price charts. But as crypto evolved, so did bitcoin optimizer review trading technology.Now, trading can be done entirely hands-free via trading bots. If you’re intrigued by the potential of automated crypto trading, this crypto trading bot review is for you. It’ll break down what these bots are, and even some of the best crypto trading bots out there. When trading Bitcoin, finding the right opportunity to maximize profits can be time-consuming and complex. It simplifies the process by offering a powerful crypto arbitrage bot, designed to automatically spot and capitalize on price differences across exchanges.

Therefore, telegram trading bots’ profitability and performance might differ significantly from the published data. Some signal bots that are marketed as profitable might in fact not be profitable. Apart from telegram trading bots equipped with AI and self-learning, these bots are not designed to learn the market and adjust to market trends.

Choose a Reliable AI Trading Platform

While your AI bot executes trades automatically, monitoring it regularly is advisable, considering that conditions in the crypto markets change rapidly. This allows you to adjust position sizes and stop-loss levels as part of risk management. AI platforms like ChatGPT allow traders to build trading bots using various programming languages. The most preferred language, however, is Python, as it facilitates easy integration of trading APIs and comes with machine learning libraries and backtesting tools. That said, trading in crypto futures is risky and requires disciplined risk management, analysis skills, and a broader understanding of the crypto markets. This does not comprise financial advice, and you should do your own research before jumping into future crypto trading.

Banana Gun: Best Multichain Telegram Trading Bot For Crypto Investors

Thanks to Artificial Intelligence (AI) technology, traders can now automate their trading strategies using bots. You will also get detailed views of your positions, margin, unrealized P&L, and liquidation prices. Additionally, Poloniex offers risk management features, including auto-margin and stop profit/loss orders, to help manage exposure. It offers a high leverage of 125x and a special Portfolio Margin Mode, which supports using multiple assets as collateral. The exchange also has a dedicated price pool of 200K $USDT for successful traders.

PrimeXBT also offers CFD trading, which are over-the-counter derivative contracts with no fixed expiration dates. Although similar to futures, CFDs are offered by brokers and not a specific exchange. Just keep in mind that this means you’re entering into a price contract with the broker itself.

The good thing is with a trading bot, you are sure it will always be active in making trades at the right time. A user can be exposed to data breaches or hacks if there is vulnerability noticed in the bot’s security measures. Therefore, it is necessary to look for bots that have a good reputation in the market.

Die besten Bitcoin Robots 2025 im Vergleich

The bot achieves this by strategically placing lending offers across the lending book to capitalize on potential interest rate spikes. All of our recommended crypto platforms are safe for futures trading. They follow strict security protocols such as cold storage, two-factor authentication, and anti-phishing codes. Choose a reputable crypto exchange platform with positive user reviews and no history of data breaches or cyberattacks. Once done, the bot will automatically place long and short orders within each grid segment, generating profits from market volatility. You can start with an investment as low as 10 $USDT with a leverage of 125x.

More Stories

Εισαγωγή στο Regency Casino και τις υπηρεσίες λεωφορείου

Εισαγωγή στο Malina Casino 6

Πλάνο Άρθρου: Crown Casino Online