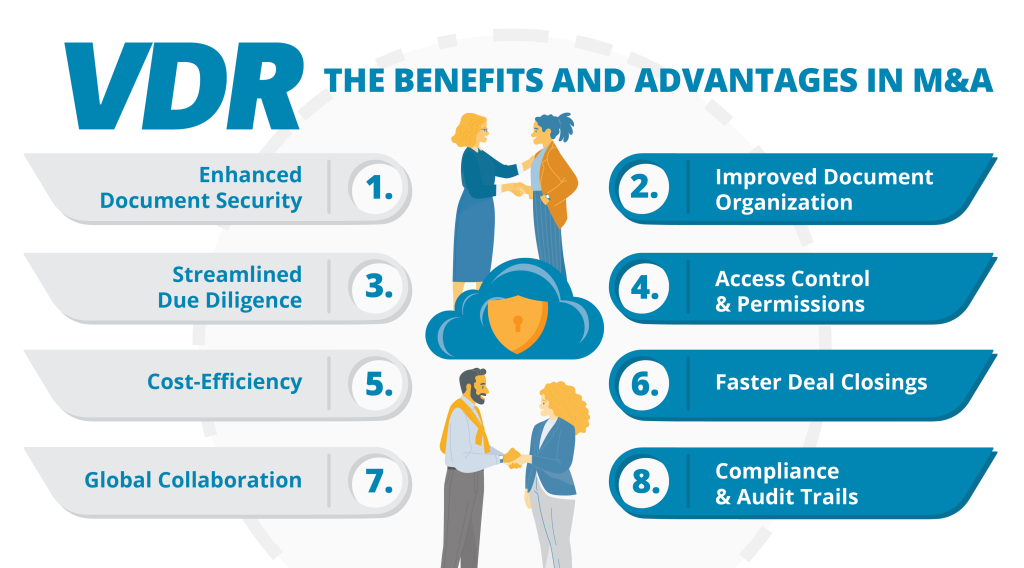

Virtual data rooms allow businesses to store and share confidential documentation with third party organizations without compromising the integrity of the documents. No matter if a construction company sharing blueprints with subcontractors, or life sciences companies are collaborating on R&D and development, vdrs provide an environment that is secure for all parties to review documents.

The most commonly used use for a vdr is due diligence in M&A deals. Investment banks require a place to organize and review documentation as well as potential investors need access to this information in a safe environment. M&A VDRs also aid in the review process by allowing users to make comments on documents, record notes and keep track of changes.

The ability of a vdr’s storage system to store and organize documents in a structured folder system is another advantage. Users are able to quickly locate the documents they need, especially when dealing hundreds of pages. Additionally, a lot of vdrs offer documents with specific permissions that can be adjusted for different teams to ensure they only see the files they require.

Some vdr providers also provide professional customer service https://dataroommart.com/beyond-documentation-unveiling-the-power-of-due-diligence-data-rooms/ via multiple channels like in-app live chat telephone, email and. Often, the customer care team speaks multiple languages and is available 24/7. The support staff will help you to navigate the complexities and get you started in the shortest time possible.

More Stories

Εισαγωγή στο Regency Casino και τις υπηρεσίες λεωφορείου

Εισαγωγή στο Malina Casino 6

Πλάνο Άρθρου: Crown Casino Online